Preparing Finances for the Addition of a Baby

Having a baby is one of the most exciting milestones in a relationship.

You and your partner get to share the intense joy of bringing a child into the world and starting your own family. While everything surrounding this new life will be exciting, it will also be expensive.

In fact, according to CNN, the average cost of having a child is anywhere between $175,000 to $372,000 (not including college!).

The exact figure depends on family income, as well as location. But these figures only calculate costs until age 17.

Fear not! While that number is overwhelming, there is hope.

When preparing finances for the addition of a baby, consider the following:

Life Insurance

One of the best ways to protect your child is to make sure that you are insured. Life insurance for you and your partner will provide financial security in the case of an emergency.

If you don’t have a life insurance plan in place, now is the time to get one.

Most employers offer plans, including matching contributions, depending on your time with the company.

If you already have a life insurance plan in place, make sure the beneficiaries are updated to reflect your spouse, child and guardian.

Medical Expenses

Babies come with tons of medical expenses:

- prenatal services

- hospital deliveries, and

- infant check-ups galore

- and more…

Making sure you have a good healthcare plan in place will protect you from shelling out an absurd amount of out-of-pocket cheddar.

BONUS TIP: If you are planning to have a baby, review your current insurance’s prenatal service coverage.

Take a look at what is and isn’t included, and how much it would be to add a dependent. Planning ahead allows you to shop around and change providers in case the coverage isn’t up to your standards.

Once the baby is born, make sure to add them to your health insurance within 30 days. You want your baby to be covered before going to all of the inevitable newborn baby checkups.

Even healthy babies need doctor visits!

Do your future-self a favor and fill out all necessary forms during pregnancy, which will make signing up a breeze.

Child Care

One of the biggest decisions you’ll need to make during pregnancy is determining whether you will go back to work or stay at home post-delivery.

There are pros and cons to each. Check some of them out here to help weigh your decision.

If you do go back to work, know that child care costs are one of the largest expenses associated with a new child.

Daycare and child care could range from $4,000 – $19,000 per year depending on where you live.

Planning ahead for these costs will save a lot of stress and un-wanted surprises for new parents.

You can also talk to your financial planner about how to write these expenses off as a deductible.

Read about the child care tax credit by Intuit to find out more.

Daycare is more expensive for infants, so see if your employer offers short-term disability coverage.

Typical policies allow you to receive part of your income for up to 6 months after your child is born. This could help save you thousands of dollars during your child’s first few months – plus give you extra time to bond without the looming worry of generating income.

Savings Funds

In order to prepare your finances for the costs related to having a baby, consider these savings funds:

1. Education Savings

When people think of ‘having kids’, the first expense that often comes to mind is college tuition.

Due to the rapidly growing prices of education, it’s wise to start saving for college immediately (remember: the first scary figure in this article does not include college tuition and associated costs).

Opening a college savings account allows you to start saving from the jump.

A 529 College Savings Plan allows you to save money, letting it grow tax-free. One of the best benefits of this is that any family member is able to contribute.

Hello gifts from grandma and grandpa!

2. Emergency Savings

Always have an emergency savings account.

If anything were to happen to you, your spouse, or your child, it is important to be prepared. A good rule of thumb is to have about 6 months worth of living costs saved in your emergency fund.

3. Retirement Savings

Once you have a baby, most people put retirement planning on hold. Don’t be most people.

Planning for your retirement is crucial. While you will be able to take out loans for homes or education, you can’t take out a loan for retirement.

Unless you want to burden your children with expenses or work until you’re 90, keep adding to your retirement savings.

The general consensus is that 10% of your salary will suffice.

Last Will and Testament

No one ever wants to think about the worst-case scenario, but you never know what could happen.

Making sure you create/update your last will and testament ensures security for your baby’s future.

Consider a trust fund, life insurance beneficiaries, as well as guardianship when creating your will.

For guardianship, make sure that you have a serious conversation with whomever you want to name as your child’s godparents. They should be willing and able to take care of your child (or children) if anything were to happen to you.

BUDGET, BUDGET, BUDGET

Creating a budget helps you to stop wasting money. Many of us don’t think we’re doing so until we begin to budget.

Luckily, there are many tools available to help you, short of hiring a professional. Check out Mint for a free budget-creating and monitoring tool and remember, keep all of your receipts!

YNAB is also a quality introduction into the world of budgeting.

Flexible Spending Accounts (FSA)

If your employer offers an FSA, take advantage of it!

A flex spending account is money deducted from your check pre-tax.

You put a certain amount of money into the account from your paycheck per pay period and use it to cover eligible expenses. This not only saves you money, but it decreases your taxable income.

TheBalance.com gives a list of approved eligible medical expenses that FSA capital can be used for.

Just make sure that you calculate how much you want to contribute per year, because it is often a use-it-or-lose-it type of account.

Groceries

If you plan on breastfeeding, you will save on the costs of baby-groceries for a while.

But eventually you will have another mouth to feed with store-bought products. Make sure to factor these costs in while budgeting for your future.

New Baby Gear

With a new baby comes new baby clothes, gear, and supplies. Think onesies and diapers, strollers and car seats, binkys and babas.

Talk to your friends and family members to find gently used clothing for free, or at least a fraction of the price, if you offer some form of compensation.

Your new baby will outgrow these items quickly and won’t hold a grudge against you for dressing him or her in last year’s fashion.

Save money where you can. You’ll want to pay more to ensure high-quality and safety with certain items (think strollers and car seats).

Spreading these costs over the course of your pregnancy is much more manageable than buying them all at once (don’t forget to take advantage of your baby shower!).

Not to mention costs related to diapers, toys, and hygienic supplies.

Conclusion

This list is a good place to start when preparing your finances for the addition of a baby.

Do you have any money-saving tips of your own that aren’t mentioned here? Share with your fellow mamas below – or post on our Facebook page!

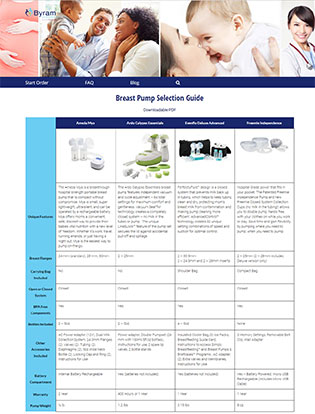

Don’t forget, once you have your first child you are eligible to receive an insurance covered breast pump at no cost from leading manufactures. Another great way to save an extra dollar!